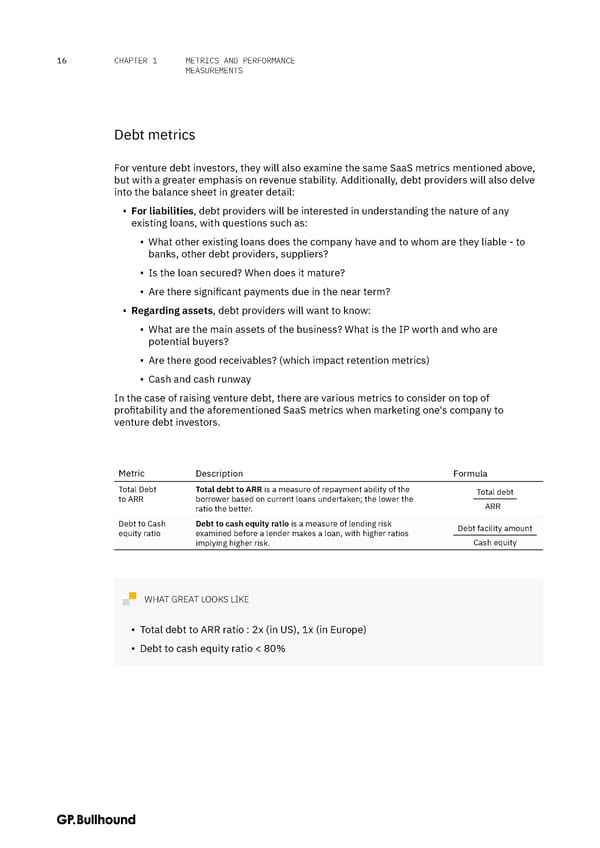

METRICS AND PERFORMANCE 16 CHAPTER 1 MEASUREMENTS Debt metrics For venture debt investors, they will also examine the same SaaS metrics mentioned above, but with a greater emphasis on revenue stability. Additionally, debt providers will also delve into the balance sheet in greater detail: ▪ For liabilities, debt providers will be interested in understanding the nature of any existing loans, with questions such as: ▪ What other existing loans does the company have and to whom are they liable - to banks, other debt providers, suppliers? ▪ Is the loan secured? When does it mature? ▪ Are there significant payments due in the near term? ▪ Regarding assets, debt providers will want to know: ▪ What are the main assets of the business? What is the IP worth and who are potential buyers? ▪ Are there good receivables? (which impact retention metrics) ▪ Cash and cash runway In the case of raising venture debt, there are various metrics to consider on top of profitability and the aforementioned SaaS metrics when marketing one's company to venture debt investors. Metric Description Formula Total Debt Total debt to ARR is a measure of repayment ability of the Total debt to ARR borrower based on current loans undertaken; the lower the ARR ratio the better. Debt to Cash Debt to cash equity ratio is a measure of lending risk Debt facility amount equity ratio examined before a lender makes a loan, with higher ratios implying higher risk. Cash equity WHAT GREAT LOOKS LIKE ▪ Total debt to ARR ratio : 2x (in US), 1x (in Europe) ▪ Debt to cash equity ratio < 80%

The CFO Handbook | GP Bullhound Page 15 Page 17

The CFO Handbook | GP Bullhound Page 15 Page 17