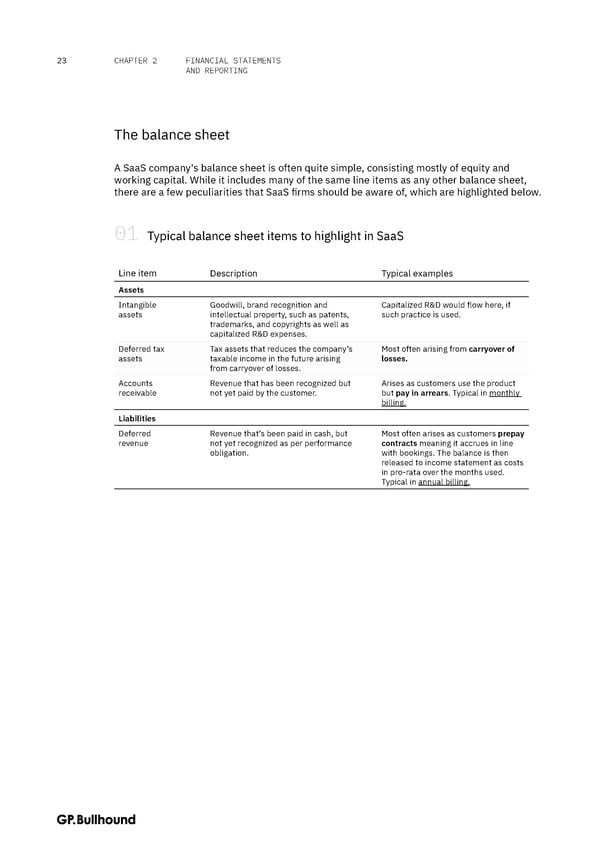

FINANCIAL STATEMENTS 23 CHAPTER 2 AND REPORTING The balance sheet A SaaS company's balance sheet is often quite simple, consisting mostly of equity and working capital. While it includes many of the same line items as any other balance sheet, there are a few peculiarities that SaaS firms should be aware of, which are highlighted below. 01 Typical balance sheet items to highlight in SaaS Line item Description Typical examples Assets Intangible Goodwill, brand recognition and Capitalized R&D would flow here, if assets intellectual property, such as patents, such practice is used. trademarks, and copyrights as well as capitalized R&D expenses. Deferred tax Tax assets that reduces the company’s Most often arising from carryover of assets taxable income in the future arising losses. from carryover of losses. Accounts Revenue that has been recognized but Arises as customers use the product receivable not yet paid by the customer. but pay in arrears. Typical in monthly billing. Liabilities Deferred Revenue that’s been paid in cash, but Most often arises as customers prepay revenue not yet recognized as per performance contracts meaning it accrues in line obligation. with bookings. The balance is then released to income statement as costs in pro-rata over the months used. Typical in annual billing.

The CFO Handbook | GP Bullhound Page 22 Page 24

The CFO Handbook | GP Bullhound Page 22 Page 24