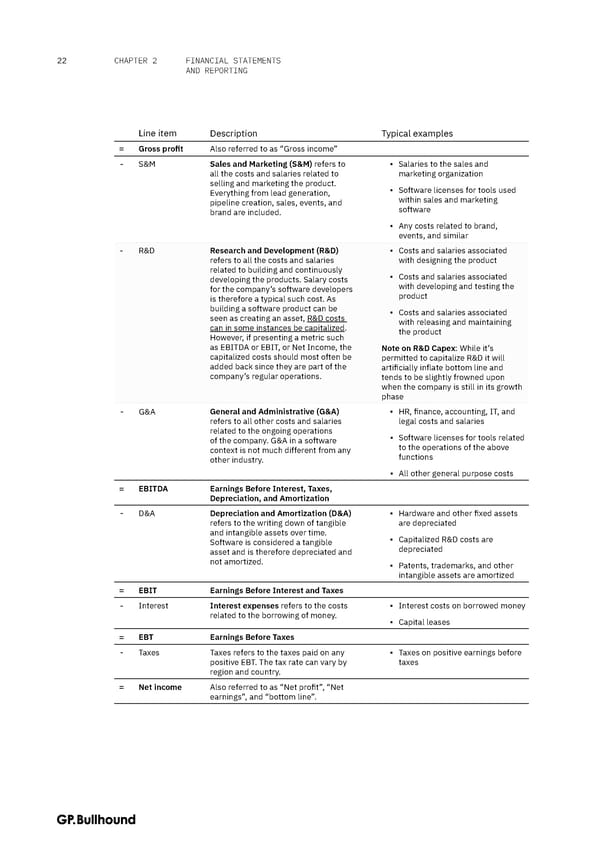

FINANCIAL STATEMENTS 22 CHAPTER 2 AND REPORTING Line item Description Typical examples = Gross profit Also referred to as “Gross income” - S&M Sales and Marketing (S&M) refers to ▪ Salaries to the sales and all the costs and salaries related to marketing organization selling and marketing the product. ▪ Software licenses for tools used Everything from lead generation, within sales and marketing pipeline creation, sales, events, and software brand are included. ▪ Any costs related to brand, events, and similar - R&D Research and Development (R&D) ▪ Costs and salaries associated refers to all the costs and salaries with designing the product related to building and continuously ▪ Costs and salaries associated developing the products. Salary costs with developing and testing the for the company’s software developers product is therefore a typical such cost. As building a software product can be ▪ Costs and salaries associated seen as creating an asset, R&D costs with releasing and maintaining can in some instances be capitalized. the product However, if presenting a metric such as EBITDA or EBIT, or Net Income, the Note on R&D Capex: While it’s capitalized costs should most often be permitted to capitalize R&D it will added back since they are part of the artificially inflate bottom line and company’s regular operations. tends to be slightly frowned upon when the company is still in its growth phase - G&A General and Administrative (G&A) ▪ HR, finance, accounting, IT, and refers to all other costs and salaries legal costs and salaries related to the ongoing operations ▪ Software licenses for tools related of the company. G&A in a software to the operations of the above context is not much different from any functions other industry. ▪ All other general purpose costs = EBITDA Earnings Before Interest, Taxes, Depreciation, and Amortization - D&A Depreciation and Amortization (D&A) ▪ Hardware and other fixed assets refers to the writing down of tangible are depreciated and intangible assets over time. ▪ Capitalized R&D costs are Software is considered a tangible depreciated asset and is therefore depreciated and not amortized. ▪ Patents, trademarks, and other intangible assets are amortized = EBIT Earnings Before Interest and Taxes - Interest Interest expenses refers to the costs ▪ Interest costs on borrowed money related to the borrowing of money. ▪ Capital leases = EBT Earnings Before Taxes - Taxes Taxes refers to the taxes paid on any ▪ Taxes on positive earnings before positive EBT. The tax rate can vary by taxes region and country. = Net income Also referred to as “Net profit”, “Net earnings”, and “bottom line”.

The CFO Handbook | GP Bullhound Page 21 Page 23

The CFO Handbook | GP Bullhound Page 21 Page 23