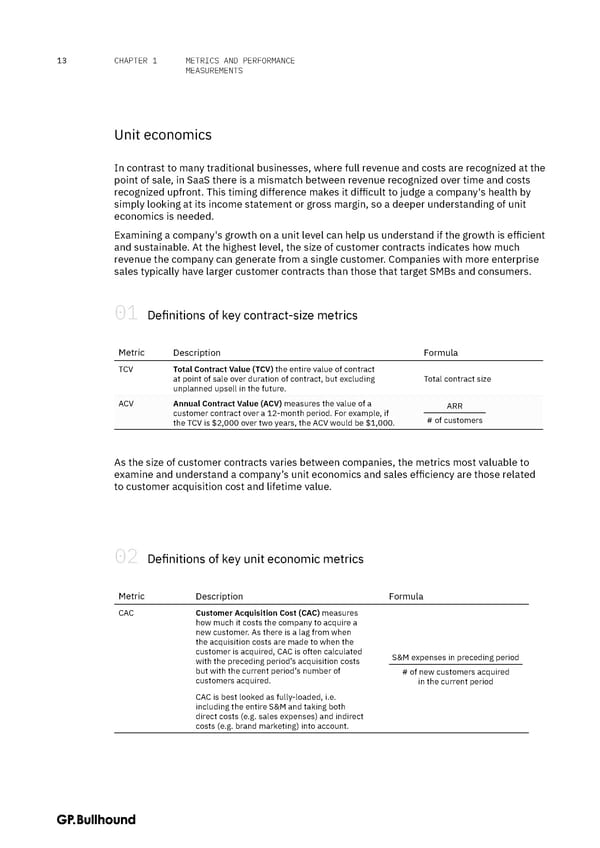

METRICS AND PERFORMANCE 13 CHAPTER 1 MEASUREMENTS Unit economics In contrast to many traditional businesses, where full revenue and costs are recognized at the point of sale, in SaaS there is a mismatch between revenue recognized over time and costs recognized upfront. This timing difference makes it difficult to judge a company's health by simply looking at its income statement or gross margin, so a deeper understanding of unit economics is needed. Examining a company's growth on a unit level can help us understand if the growth is efficient and sustainable. At the highest level, the size of customer contracts indicates how much revenue the company can generate from a single customer. Companies with more enterprise sales typically have larger customer contracts than those that target SMBs and consumers. 01 Definitions of key contract-size metrics Metric Description Formula TCV Total Contract Value (TCV) the entire value of contract at point of sale over duration of contract, but excluding Total contract size unplanned upsell in the future. ACV Annual Contract Value (ACV) measures the value of a ARR customer contract over a 12-month period. For example, if # of customers the TCV is $2,000 over two years, the ACV would be $1,000. As the size of customer contracts varies between companies, the metrics most valuable to examine and understand a company’s unit economics and sales efficiency are those related to customer acquisition cost and lifetime value. 02 Definitions of key unit economic metrics Metric Description Formula CAC Customer Acquisition Cost (CAC) measures how much it costs the company to acquire a new customer. As there is a lag from when the acquisition costs are made to when the customer is acquired, CAC is often calculated S&M expenses in preceding period with the preceding period’s acquisition costs but with the current period’s number of # of new customers acquired customers acquired. in the current period CAC is best looked as fully-loaded, i.e. including the entire S&M and taking both direct costs (e.g. sales expenses) and indirect costs (e.g. brand marketing) into account.

The CFO Handbook | GP Bullhound Page 12 Page 14

The CFO Handbook | GP Bullhound Page 12 Page 14