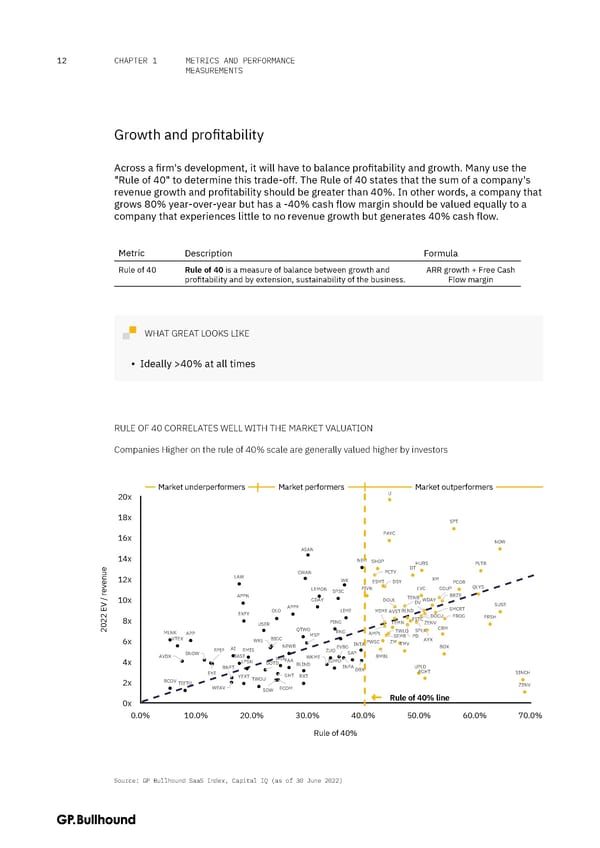

METRICS AND PERFORMANCE 12 CHAPTER 1 MEASUREMENTS Growth and profitability Across a firm's development, it will have to balance profitability and growth. Many use the "Rule of 40" to determine this trade-off. The Rule of 40 states that the sum of a company's revenue growth and profitability should be greater than 40%. In other words, a company that grows 80% year-over-year but has a -40% cash flow margin should be valued equally to a company that experiences little to no revenue growth but generates 40% cash flow. Metric Description Formula Rule of 40 Rule of 40 is a measure of balance between growth and ARR growth + Free Cash profitability and by extension, sustainability of the business. Flow margin WHAT GREAT LOOKS LIKE ▪ Ideally >40% at all times RULE OF 40 CORRELATES WELL WITH THE MARKET VALUATION Companies Higher on the rule of 40% scale are generally valued higher by investors Market underperformers Market performers Market outperformers 20x U 18x SPT 16x PAYC NOW ASAN 14x NE M SHOP HUBS PLTR CWAN PCTY DT 12x LAW WK ESMT DSY XM enue PCOR v LEMON FIVN LVC COUP QLYS e SPSC BRZE 10x APPN CDAY DOUL TENB WDAY V / r APPF DV SUSE OLO LIME MIMEAVSTBLND SMCRT EXFY DOCU FROG FRSH 8x PING TEMN ESTCZENV USER CRM 2022 E MLNK APP QTWO RNG AMPL TWLO SPLK VTEX BIGC MSP SEMR PD AYX 6x WKL INTA PWSC ZM TMV FPIP AI EMIS NEWR ZUOEVBG BOX AVDX SNOW BASE WKME SAP BMBL WIX 4x LPSN DOTD FAA BLIND SUMO BNFT INFADBX UPLD EYE YEXT GHT RXT EGHT SINCH 2x BCOV TIETO TWOU WEAV ECOM ZENV SOW Rule of 40% line 0x 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% Rule of 40% Source: GP Bullhound SaaS Index, Capital IQ (as of 30 June 2022)

The CFO Handbook | GP Bullhound Page 11 Page 13

The CFO Handbook | GP Bullhound Page 11 Page 13