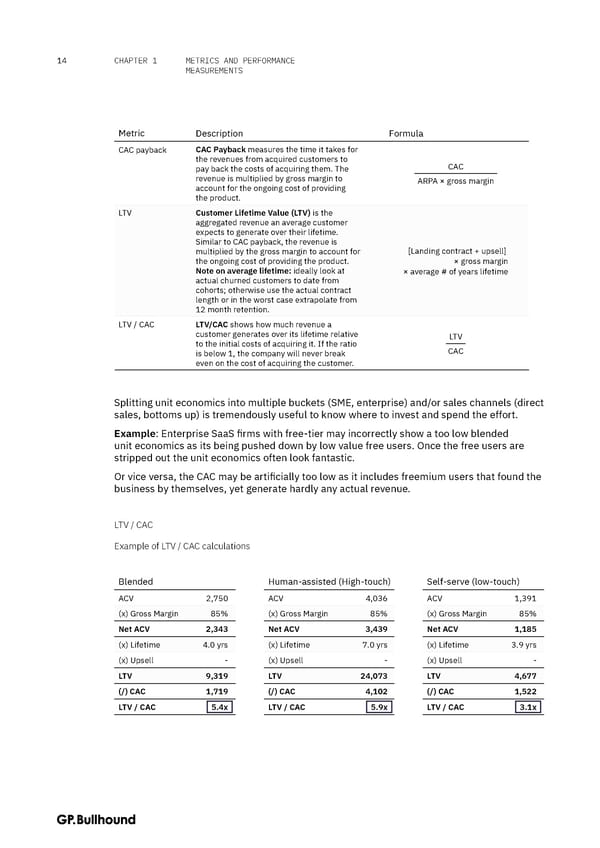

14 CHAPTER 1 METRICS AND PERFORMANCE MEASUREMENTS Metric Description Formula CAC payback CAC Payback measures the time it takes for the revenues from acquired customers to CAC pay back the costs of acquiring them. The revenue is multiplied by gross margin to ARPA × gross margin account for the ongoing cost of providing the product. LTV Customer Lifetime Value (LTV) is the aggregated revenue an average customer expects to generate over their lifetime. Similar to CAC payback, the revenue is multiplied by the gross margin to account for [Landing contract + upsell] the ongoing cost of providing the product. × gross margin Note on average lifetime: ideally look at × average # of years lifetime actual churned customers to date from cohorts; otherwise use the actual contract length or in the worst case extrapolate from 12 month retention. LTV / CAC LTV/CAC shows how much revenue a customer generates over its lifetime relative LTV to the initial costs of acquiring it. If the ratio CAC is below 1, the company will never break even on the cost of acquiring the customer. Splitting unit economics into multiple buckets (SME, enterprise) and/or sales channels (direct sales, bottoms up) is tremendously useful to know where to invest and spend the effort. Example: Enterprise SaaS firms with free-tier may incorrectly show a too low blended unit economics as its being pushed down by low value free users. Once the free users are stripped out the unit economics often look fantastic. Or vice versa, the CAC may be artificially too low as it includes freemium users that found the business by themselves, yet generate hardly any actual revenue. LTV / CAC Example of LTV / CAC calculations Blended Human-assisted (High-touch) Self-serve (low-touch) ACV 2,750 ACV 4,036 ACV 1,391 (x) Gross Margin 85% (x) Gross Margin 85% (x) Gross Margin 85% Net ACV 2,343 Net ACV 3,439 Net ACV 1,185 (x) Lifetime 4.0 yrs (x) Lifetime 7.0 yrs (x) Lifetime 3.9 yrs (x) Upsell - (x) Upsell - (x) Upsell - LTV 9,319 LTV 24,073 LTV 4,677 (/) CAC 1,719 (/) CAC 4,102 (/) CAC 1,522 LTV / CAC 5.4x LTV / CAC 5.9x LTV / CAC 3.1x

The CFO Handbook | GP Bullhound Page 13 Page 15

The CFO Handbook | GP Bullhound Page 13 Page 15