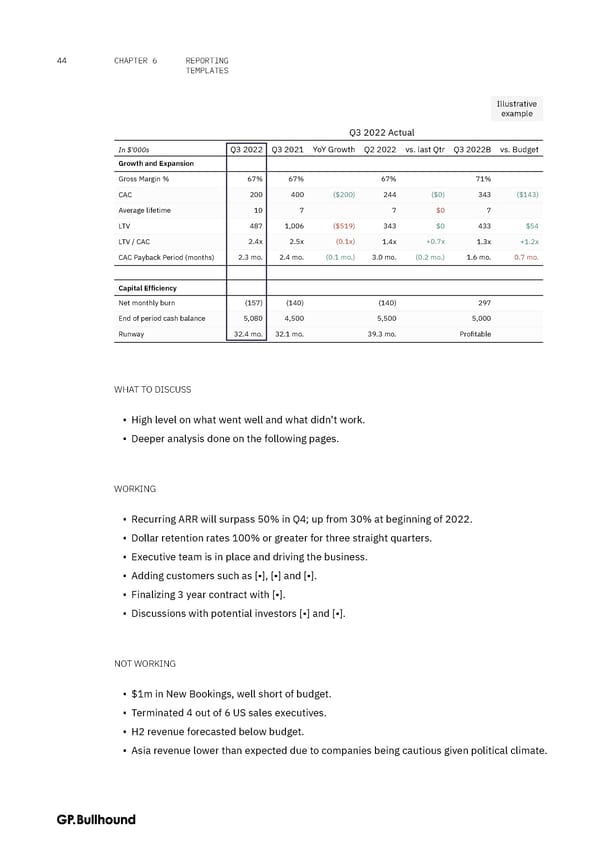

44 CHAPTER 6 REPORTING TEMPLATES Illustrative example Q3 2022 Actual In $'000s Q3 2022 Q3 2021 YoY Growth Q2 2022 vs. last Qtr Q3 2022B vs. Budget Growth and Expansion Gross Margin % 67% 67% 67% 71% CAC 200 400 ($200) 244 ($0) 343 ($143) Average lifetime 10 7 7 $0 7 LTV 487 1,006 ($519) 343 $0 433 $54 LTV / CAC 2.4x 2.5x (0.1x) 1.4x +0.7x 1.3x +1.2x CAC Payback Period (months) 2.3 mo. 2.4 mo. (0.1 mo.) 3.0 mo. (0.2 mo.) 1.6 mo. 0.7 mo. Capital Efficiency Net monthly burn (157) (140) (140) 297 End of period cash balance 5,080 4,500 5,500 5,000 Runway 32.4 mo. 32.1 mo. 39.3 mo. Profitable WHAT TO DISCUSS ▪ High level on what went well and what didn’t work. ▪ Deeper analysis done on the following pages. WORKING ▪ Recurring ARR will surpass 50% in Q4; up from 30% at beginning of 2022. ▪ Dollar retention rates 100% or greater for three straight quarters. ▪ Executive team is in place and driving the business. ▪ Adding customers such as [•], [•] and [•]. ▪ Finalizing 3 year contract with [•]. ▪ Discussions with potential investors [•] and [•]. NOT WORKING ▪ $1m in New Bookings, well short of budget. ▪ Terminated 4 out of 6 US sales executives. ▪ H2 revenue forecasted below budget. ▪ Asia revenue lower than expected due to companies being cautious given political climate.

The CFO Handbook | GP Bullhound Page 43 Page 45

The CFO Handbook | GP Bullhound Page 43 Page 45